Merchant Cash Advance to assist with any business need

Our merchant cash advance helps you plan for a successful future. Get fast access to the working capital you need to grow your business.

What is a Merchant Cash Advance?

A merchant cash advance (MCA) gives businesses fast access to working capital based on future credit card or other receivables so they can meet their business needs. This type of funding is an alternative form of financing that works by giving businesses upfront access to a lump sum in return for a portion of the future revenue receivables at a discounted price. This allows the payment timeline to be tailored to the flow of business sales.

To be approved for an MCA, certain criteria must be met. Important qualifying factors are that the business must accept credit card payments or have other receivables.

At Rapid Finance, applying for an MCA is fast and convenient. You can complete the application for your business through our online portal in just a few minutes. Our merchant cash advance amounts start at $5,000 and range up to $500,000.

Which Business Is Ideal for This Type of Small Business Financing?

Flexible Payments

Automatic payments are calculated based on a percentage of the business’ credit card sales or other revenue receivables

Estimated Completion Date**

Payments are based on the business’ receivables so there is no fixed payment term

Cost and Fees

The receivables are purchased at a discounted price; fees may be charged and deducted from the advance amount

Businesses that accept credit card payments and need fast access to capital funds are ideal candidates. Aside from having a simpler application process, cash advances are designed to help businesses get flexible access to the working capital they need quickly. The reason an MCA provides flexibility is that it has variable payments based on future revenue receivables.

If your business has high credit card sales, lots of receivables, or is seasonal, then a merchant cash advance might be ideal.

**An estimated completion date is calculated based on the estimated time it will take the business to deliver the receivables (which will vary based on the business’ performance). These estimated completion dates typically range between 3 months up to 18 months, but this is only an estimate.

Grow Your Business Fast With a Merchant Cash Advance

Your business only needs 4 important things to apply.

A valid form of identification

Business bank account number and routing

Last three months of business bank statements

Last three months of credit card processing statements

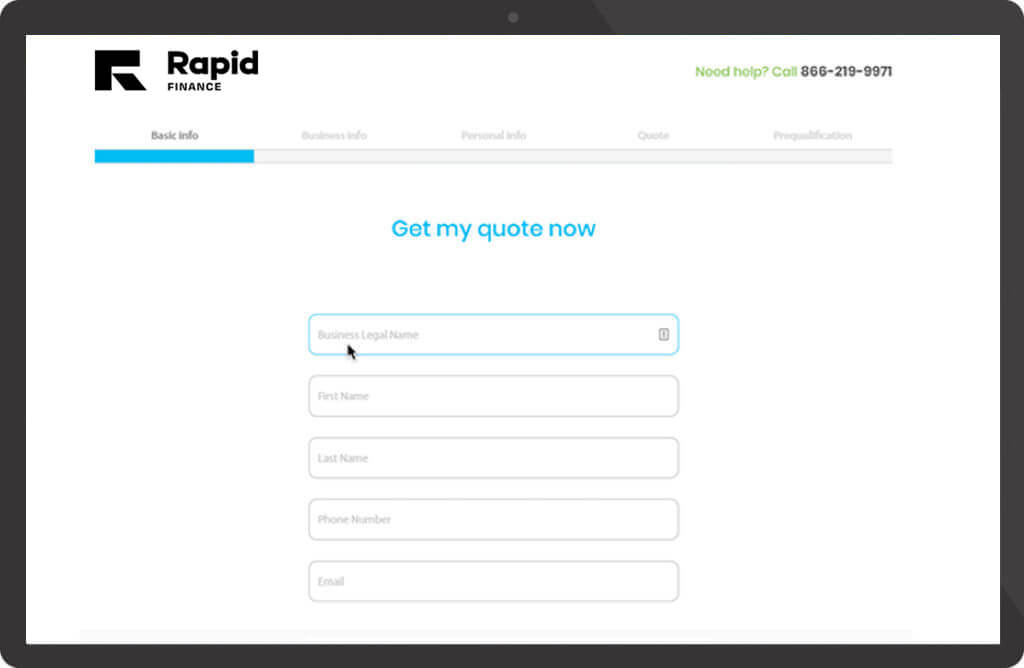

Application Process

Visit our online portal to fill out an application. The application takes just a few minutes and can be completed on mobile, tablet, or computer. We recommend having the necessary paperwork on-hand to make the process even faster.

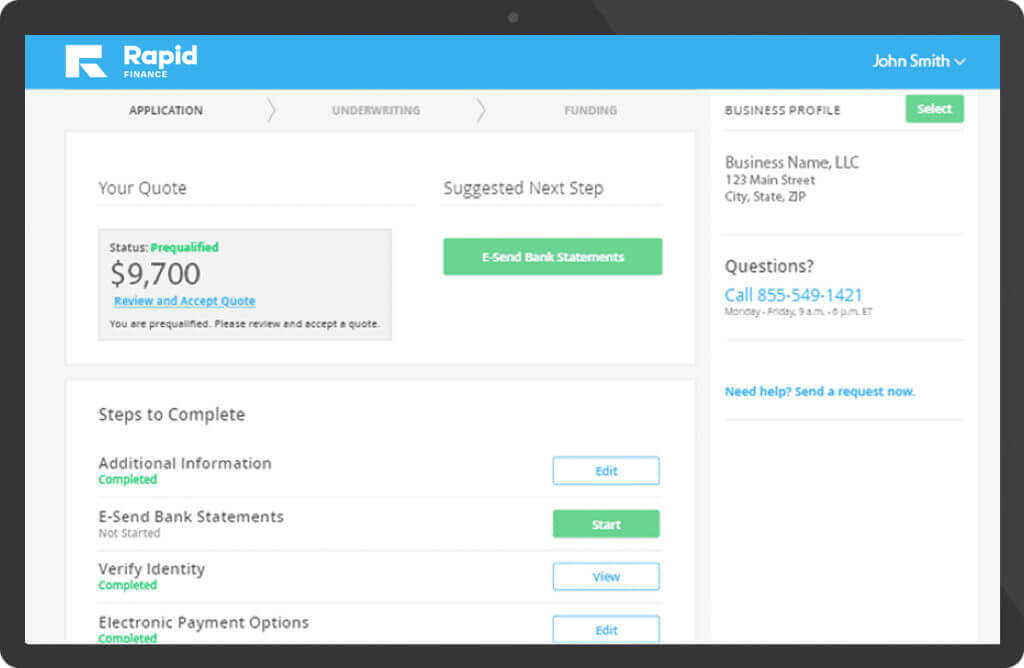

Our team will carefully review your business financing application. One of our trusted business advisors will reach out if we need any additional information.

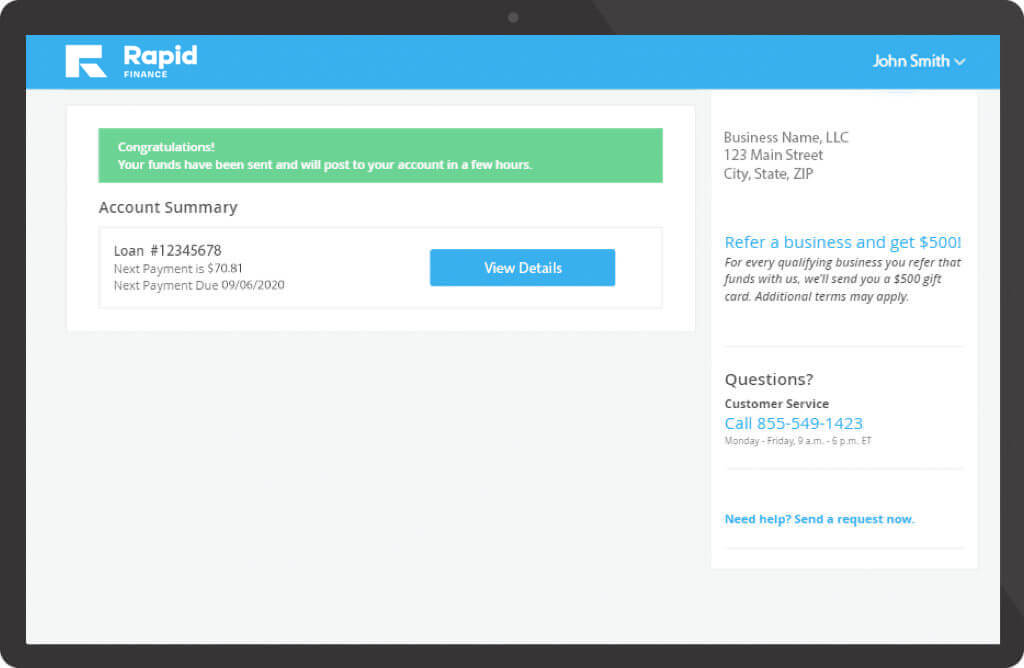

If approved, our team will send your funds to the business bank account provided. This takes a matter of minutes, so be on the lookout!

Merchant Cash Advance FAQs

A merchant cash advance works by granting businesses access to working capital in return for a portion of their future credit card or other receivables at a discounted price. Small businesses can apply online and, if approved, we’ll send the funds to the business bank account provided.

A small business that wants to apply for a merchant cash advance must have accounts receivable such as credit/debit card sales and invoices. After they apply, the alternative funder will need to review credit card processing statements, business bank account statements, invoices, and other important documents.

While many small business funding companies use personal or business credit as a factor when looking at your financing application, it’s not the only determining factor as to whether an application is approved or not. Most alternative small business funders take into consideration the overall performance of your business by looking at business revenue, time in business, accounts receivable, and business credit history.

Merchant cash advances allow access to quick working capital with flexible payment options that tend to be more flexible than traditional small business loans.

With upfront access to working capital, businesses can more quickly fund their needs. By basing payments on a portion of future receivables, it allows for a more flexible payments. Cash advances are ideal for businesses that are seasonal or have high credit card sales/lots of receivables.

Yes. A merchant cash advance is the same as a business cash advance, just with different terminology.

A merchant cash advance is a purchase and sales transaction where a financing company purchases a portion of a business’s future revenue stream at a discount in exchange for an upfront sum of working capital.

A small business loan is when a financing company lends money to a borrower and the borrower must repay the small business loan with fixed payments.

Merchant Cash Advance with Rapid Finance

At Rapid Finance, we’re dedicated to unlocking big potential for your small business. Consider us part of your team, helping your business grow with flexible financing solutions tailored to your business’ unique needs.

- Trusted by over 30 thousand small businesses

- Innovative funding technology that allows you to apply on any mobile, tablet, or computer device

- Team of actual business advisors who provide fast, simple, and trusted funding information

- A streamlined process for additional funding needs